The Duality of Man(made cryptocurrencies): How Solayer's $sUSD Enables the Open Internet

Why another stablecoin? What makes this one different, and how does it actually benefit you as a user? Let's go, sUSD!

What Exactly is $sUSD, and Why Should You Care?

$sUSD isn’t just a stablecoin, but a new breed of yield-bearing stablecoins that’s backed by something rock-solid: U.S. Treasury Bills (T-bills). If you’re used to stableco

ins that stay pegged to the dollar but don’t offer anything else, $sUSD’s approach will sound refreshing as it kills two birds with one stone: yield generation and infrastructure security.

Now, I know us crypto natives might take a step back hearing the word “government,” but historical data have shown that T-bills are highly secure, low-risk assets backed by the U.S. government, designed to provide stability. Instead of just holding a fixed value, $sUSD actually generates yield—interest that gets paid to you as a holder in the form of $USDC.

So, How Does This Yield Generation Work?

When $sUSD is backed by T-bills, it doesn’t just sit there. These T-bills earn interest of around 4-5% annually, and $sUSD passes that interest back to you. This means that, unlike traditional stablecoins, $sUSD acts like a kind of “savings account” on the blockchain, offering stability with a side of passive income.

As long as you have $sUSD in your wallet, Solana's Token 2022 Program will relay the interests back to you while operating fully onchain. Note that this is different from minting new tokens for every new holder: Instead, it accrues interests on a second-basis. For anyone looking to grow their assets without taking on huge risks, this yield-generation approach could be a game-changer.

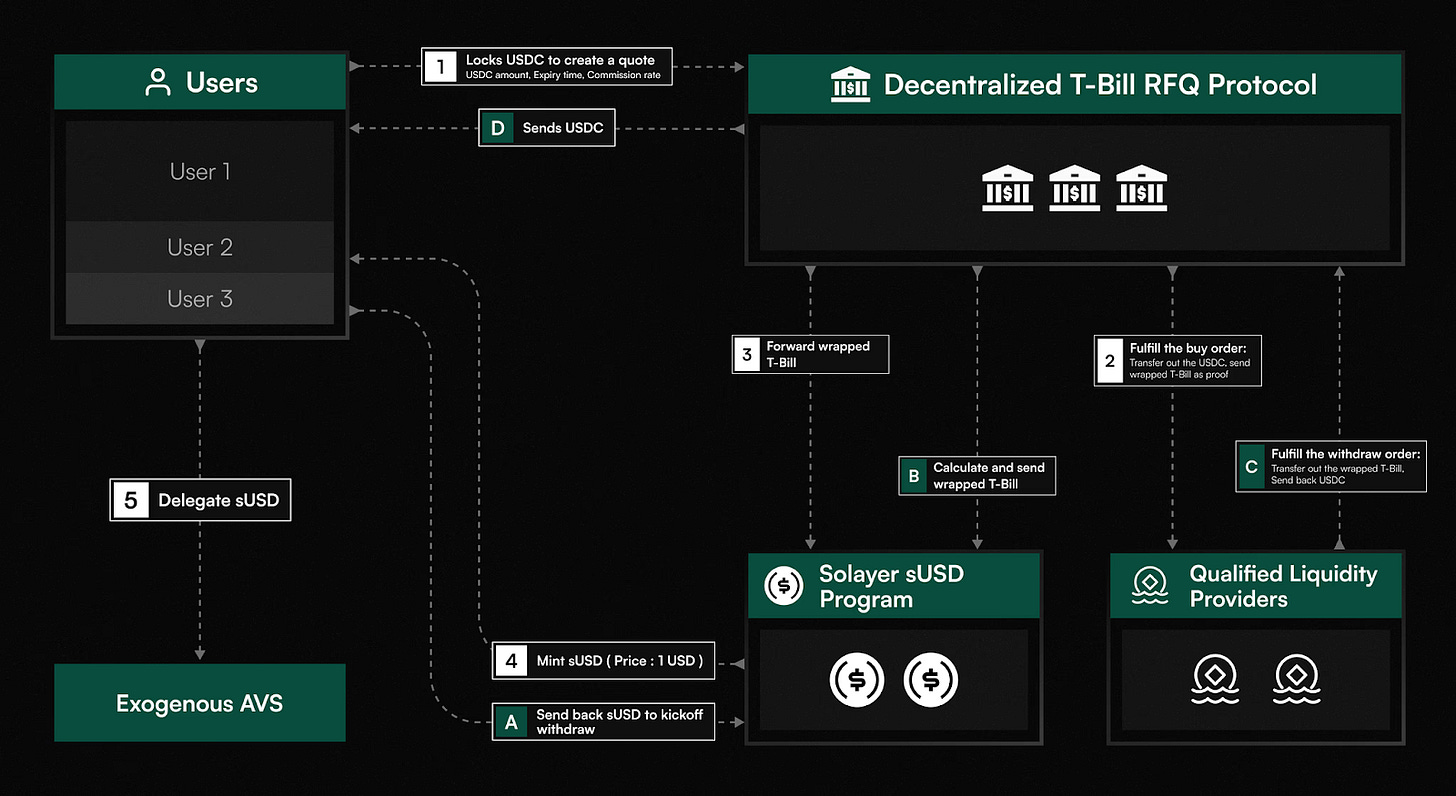

sUSD is minted through a decentralized process that involves users locking USDC, which is then converted into wrapped T-Bills. This mechanism allows users to earn interest without manual intervention, leveraging multiple liquidity providers to maximize yield and minimize risks.

Participants in the $sUSD Minting Process

Users: Lock USDC to initiate transactions.

Qualified Liquidity Providers (QLPs): Fulfill buy orders and facilitate the conversion of USDC to wrapped T-Bills.

sUSD Minting Program: Mints sUSD based on the value of wrapped T-Bills.

The sUSD Pool operates using a decentralized, non-custodial Request for Quote (RFQ) protocol, enhancing capital efficiency and promoting fair pricing while reducing market manipulation risks.

Subscription Process

User Locks USDC: The process begins when a user locks USDC, generating a quote detailing the amount, expiry, and commission.

QLP Fulfillment: A QLP fulfills the order by transferring USDC in exchange for a wrapped T-Bill.

Forwarding Wrapped T-Bill: The wrapped T-Bill is sent to the sUSD minting program for locking.

Minting sUSD: The program mints sUSD based on the wrapped T-Bill's value, maintaining a 1:1 peg with USDC.

Delegate sUSD (Coming Soon): Users can delegate sUSD to secure exogenous AVSs when available.

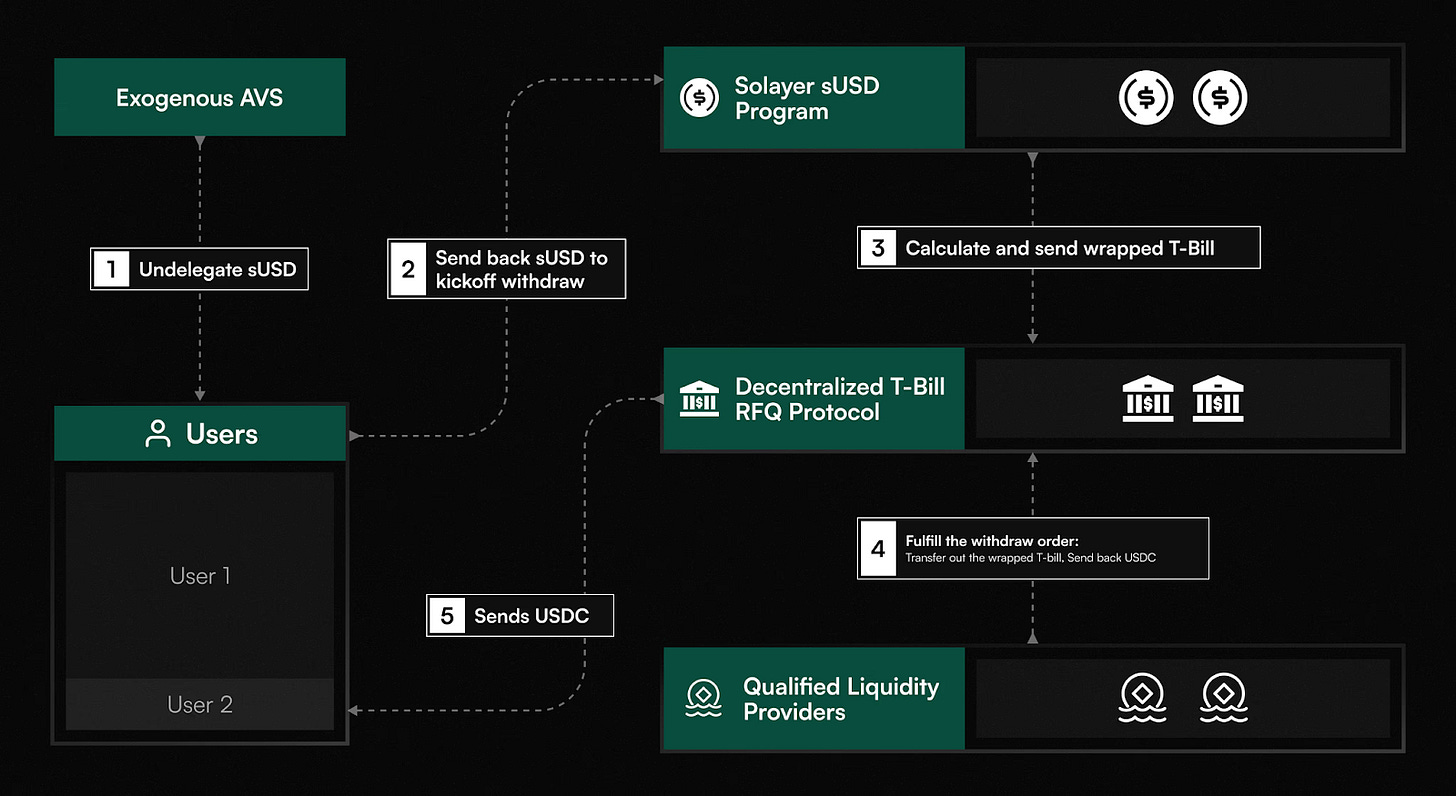

Redemption Process

Undelegate sUSD: Users request to undelegate their sUSD.

Return sUSD: Users send back sUSD to the program to initiate withdrawal.

Calculate Wrapped T-Bill: The program determines the corresponding wrapped T-Bill amount.

QLP Fulfills Withdrawal: The QLP redeems the wrapped T-Bill and transfers the corresponding USDC back.

USDC Returned to User: The protocol completes the withdrawal by returning USDC to the user.

What Problems is $sUSD Solving?

Stablecoins are among the most demanded crypto assets, with daily transfers reaching $150 billion in Q1 2024 and over $10 trillion settled in 2023. However, they largely depend on traditional banking infrastructure, which undermines the core promise of cryptocurrency: individual freedom. To fully realize their potential, significant efforts are needed to bring stablecoins on-chain, ensuring they are decentralized and user-owned, allowing users complete control over their assets.

$sUSD addresses these issues by being fully backed by tangible, government-backed assets. Here’s how this can benefit you:

Increased Security and Stability

$sUSD’s backing by U.S. T-bills helps ensure its stability. If you’re concerned about stablecoins “depegging”, this T-bill backing gives $sUSD extra resilience against market swings. Unlike algorithmic stablecoins, which have failed in the past, $sUSD’s approach offers a safety net that’s hard to match.Earning Passive Income

With $sUSD, you’re not just holding a stablecoin; you’re earning yield. So, if you’re someone who likes the stability of cash but also wants to see some growth, $sUSD might be an appealing choice. You get the benefit of a reliable store of value, plus a yield that’s comparable to what you might see in a traditional savings account—without the banking middleman.Decentralized and Permissionless

Some stablecoins require you to go through centralized exchanges or even banks, but $sUSD is decentralized. Through Solayer’s RFQ (Request for Quote) protocol, minting and redeeming $sUSD is permissionless, meaning anyone with $USDC can participate. This accessibility gives you freedom—no need to rely on a traditional financial institution to access the asset.

Why Choose $sUSD Over Other Stablecoins?

Stablecoins can be confusing; after all, there are so many of them! So, why would you pick $sUSD specifically? It all comes down to the combination of stability, income, and flexibility it offers:

Stable, Reliable Backing: If you’re looking for safety, $sUSD’s T-bill backing adds a layer of security. T-bills are government-backed, historically low-risk investments, meaning $sUSD isn’t subject to the high volatility seen in other types of crypto assets.

Built-in Passive Income: Traditional stablecoins don’t grow in value while you hold them, but $sUSD does. For anyone who prefers to keep a stable asset while also earning yield, $sUSD gives you both benefits.

Permissionless Access: You don’t need to go through extensive processes to mint or redeem $sUSD. As long as you have $USDC and internet access, you’re set.

But How Safe is $sUSD Really?

For a stablecoin, transparency and security are essential. $sUSD’s backing by real-world assets and its fully decentralized, on-chain system mean you can track everything. Many traditional financial systems or even other stablecoins don’t offer this level of insight, so this is a big plus for users who want more control and visibility. This level of transparency aims to build trust, especially among those skeptical about crypto.

How Does $sUSD Benefit the Solana Ecosystem?

You might be wondering, “What’s in it for Solana?” Well, $sUSD isn’t just good for users—it strengthens the Solana network as a whole. By using $sUSD, users add liquidity and stability to Solana’s DeFi ecosystem. This contributes to a stronger, more resilient network, as $sUSD can be used as collateral in DeFi platforms, lending protocols, and even cross-border transactions.

Enhanced Security Through exoAVS

$sUSD supports Solana’s network stability by working with exoAVS (external systems actively validated by the network). This technical setup means $sUSD doesn’t just benefit users—it also supports Solana’s infrastructure, helping to keep the network secure and resilient.

Check out my other blog article about Solayer here (it’s in Vietnamese, so you might want to turn on your Google Translate!)

Practical Applications Across DeFi and Real-World Use

Think of $sUSD as a stablecoin that adapts to your financial needs. It’s a stable asset for DeFi applications—staking, lending, and more. It’s also practical for real-world use, especially in regions where local currencies are volatile. Need to send money internationally or hedge against inflation? $sUSD can be an efficient solution without the usual banking fees or delays.

How to Mint Your $sUSD

Step 1: Convert all stablecoins into USDC

Step 2: Visit app.solayer.org

Step 3: Deposit USDC to redeem sUSD

Step 4: Receive sUSD in your wallet

Step 5: Earn 4.33% Treasury Bill yield in USDC

Step 6: Earn exo AVS delegation reward (coming soon)

Final Thoughts: Is $sUSD Worth Trying?

If you’re looking for a stable asset in the world of crypto, $sUSD has a lot to offer. It’s designed for users who want stability, income, and flexibility—all in one package. With $sUSD, you don’t just hold a stablecoin; you hold a yield-bearing asset backed by a highly secure, traditional asset (U.S. Treasury Bills). Plus, the entire system is transparent, letting you verify the stability and yield-generating process anytime on Solana’s blockchain.

For the Solana network, it’s a stable asset that reinforces the ecosystem. And for the DeFi community, $sUSD signals the potential for stablecoins to serve as more than just digital dollars: They can be active financial tools that grow value and support networks. If you’re ready for a stablecoin that does more, $sUSD might be worth a closer look.